Why invest in Dominican Free Zones?

ECONOMIC AND POLITICAL STABILITY - The Dominican Republic is one of the fastest growing economies in Latin America and is recognized for its political and social stability that has contributed to the country's sustainable development.

CONNECTIVITY - Located in the center of the Caribbean, the Dominican Republic has one of the best logistics infrastructures in Latin America, including 9 international airports and 13 seaports, with access to the main destinations in the world.

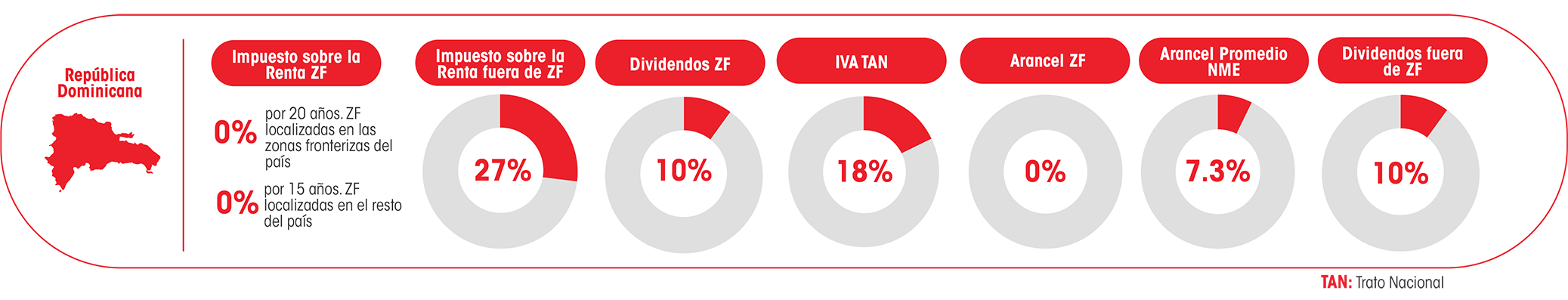

FISCAL REGIME - 100% exemption from municipal and national taxes.

HUMAN CAPITAL - Great source of talent in the technical and professional areas, undergraduate and graduate, focused on STEM and administrative careers.

TRADE AGREEMENTS - The Dominican Republic has free trade agreements with more than 40 countries, allowing access to more than 1,000 million consumers around the world, including the United States, the European Union, America Central and Caribbean.

LICENSES AND PERMITS - The process of application, approval and installation of free zone companies in the Dominican Republic is characterized by being agile and expeditious.